Lithography systems: China remains ASML's most important customer

The Dutch company ASML made the most money with lithography systems for China in early 2024, despite the tightened trade restrictions.

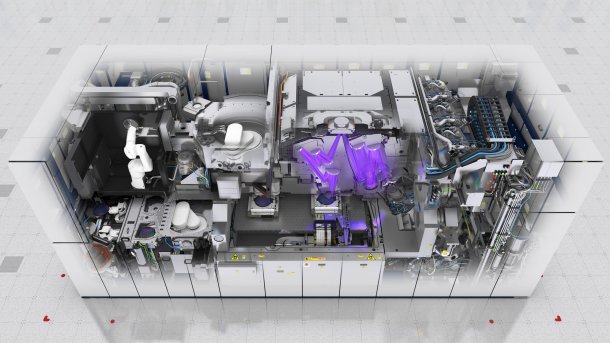

ASML's EUV imagesetter NXE:3400 from the inside. The system is not available to Chinese customers.

(Bild: ASML)

ASML sold most of its lithography machines for chip production to China in the first quarter of 2024. Chinese chip contract manufacturers such as SMIC – accounted for almost half of the revenue from system sales, equivalent to approximately 1.9 billion euros. Surprisingly, Europe, the Middle East and Africa (EMEA) was the second largest target region with a share of 20 percent. Traditionally, the European share of ASML sales is lower.

In the analysts' conference on the latest business figures, ASML CEO Peter Wennink and CFO Roger Dassen confirmed that Chinese chip contract manufacturers remain important customers despite the tightened sanctions (transcript on Seeking Alpha). So these were not just bookings from last year, before the stricter rules came into force at the turn of the year,

Dassen noted that ASML had not been granted another exceptional licence to supply modern lithography systems to China. In addition to the expensive platesetters with extreme ultraviolet (EUV) exposure technology, this also affects some systems with deep ultraviolet (DUV) light, which work with a wavelength of 193 instead of 13.5 nanometers. The export ban excludes DUV models that were released after 2015 and expose wafers particularly quickly and align them precisely.

Mature production technology in demand

According to ASML, Chinese companies are currently particularly interested in lithography systems that are designed for old production generations – so-called mature nodes. This includes controllers and sensors with 90 nanometers and even coarser structures.

"China is strong. And of course it's not just 'Mature', but 'Mature' is a very significant part of what China is adding," Dassen said. "Yes, China is strong, but China is strong because it's adding capabilities that we think the world needs."

"And yes, as a result, China's share and world market share will become larger over the years than it is today. The country's level of self-sufficiency will increase compared to today. But we believe that what China is adding in mature capacity today is reasonable and in line with our expectation of what needs to be added in capacity, including 'mature', to achieve what the world needs in the second half of the decade."

(Bild: ASML)

Sales and profit slumped

In the first quarter of 2024, ASML generated total sales of just under 5.3 billion euros. Approximately 1.3 billion euros was attributable to the maintenance of lithography systems already sold to customers such as chip contract manufacturers TSMC, Samsung, Intel and Chinese manufacturers such as SMIC. The US government is currently urging the Netherlands to discontinue ASML's services for Chinese companies. However, ASML does not expect any additional restrictions in the medium term.

Net profit slumped to just over 1.2 billion euros. Unlike the sales of the manufacturers of processors and graphics cards, ASML's sales do not fluctuate so strongly with the seasons. For this reason, the company itself is not comparing the figures with the same period of the previous year, but with the end of 2023 – when sales were still a good 7.2 billion euros and net profit was just over two billion euros.

Production of lithography systems has almost halved, from 113 to 66 new machines and four instead of eleven remanufactured units. As ASML has open orders worth tens of billions of euros, this indicates that customers are delaying delivery of equipment that has already been ordered. Meanwhile, new orders have slumped the most: ASML received bookings worth 3.6 billion euros at the beginning of 2024 – At the end of 2023, there were still some for 9.2 billion euros.

ASML had already anticipated the decline. Accordingly, chip manufacturers are currently cautious due to the weakening semiconductor market. It is expected to grow significantly again in the second half of the year. The ASML share has fallen by around six percent since the announcement of the business figures.

(mma)